My knees are paining from the long prayers and I am not even a bear! So the lessons learned are that never go against the 1st instinct and greed kills. Because of that I have missed almost seventy points rally in SPX and is now worried about saving the capital however small capital portion allocation it may be. I have crows in the oven and if by February 17, the market does not pull-back in a significant manner, those will be my breakfast, lunch and dinner.

Calling the top or bottom is a risky business and in future the strategy will be different. For this particular short trade, everything including Cycles and TAs failed. And knowing that the reversal is round the corner does not help either. At least for this cycle, the predictions are working out correct. The cycles pointed out top by February 2-8 and here we are.

Today, while equities and AUD were jumping out of the window, other risk assets were actually down. Gold, silver, oil, Euro all were down. So while I want to get bullish, I am unable to become one. May be my inability to believe is costing me money. I should JBTFD. But if the employment situation is improving and economy is on the mend, as O was saying today, then what happens to the QE trade. Will it unwind?

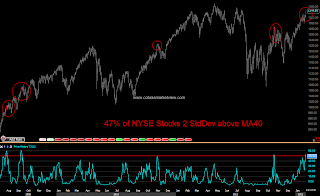

And here is a chart by great Mr. Cobra who is a treasure trove of market indicators.

I encourage readers to visit his site.

But we have a new high today and rarely a new high is the turning point. So it is quite possible that Monday, February 6, we will see the momentum going and SPX will reach 1360 before any pull-back. That is just fifteen points away. At this point it does not matter if it is fundamentally meaningful because the entire rally has been fuelled by liquidity and the law of gravity has been suspended by the Fed.

2012 is going to be the year of the Bulls. Reason I say this is because of the humongous long Euro position that the commercials are building up for many months now. Here is the latest for this week.

When all the CBs are flooding the world with free money, call it anything, it is still QE. So we might as well JBTFD.