New SPACs - Terragali & Australaysia; Goldis-IGB; Excessive directors' compensation.

http://www.bfm.my/sm-salvatore-dali-malaysiafinance-spacs-overpaid-directors.html

http://www.bfm.my/snm-show.html

Wednesday, May 29, 2013

Tuesday, May 28, 2013

Saturday, May 25, 2013

Why So Few Female Traders

When you speak off the cuff, silly sounding things can pop out. Thats why I am so reluctantly to speak quickly over the radio, and I need pauses so that i don't say things such as those said by Paul Tudor Jones.

For a billionaire hedge fund manager who carefully manages his public image, Paul Tudor Jones had a minor crisis on his hands. Mr. Jones, a billionaire and philanthropist of legendary stature in the minds of many Wall Street traders, was forced on Thursday to explain what he meant in remarks that surfaced in a video published by The Washington Post. The video, depicting a University of Virginia symposium in April, shows Mr. Jones trying to explain why there is a scarcity of female traders.

“As soon as that baby’s lips touch that girl’s bosom, forget it,” Mr. Jones, who has three daughters, says in the video. “Every single investment idea, every desire to understand what’s going to make this go up or go down, is going to be overwhelmed by the most beautiful experience, which a man will never share, about a mode of connection between that mother and that baby.”

“I’ve just seen it happen over and over,” he added. “I’m talking about trading, not managing.” The video was obtained through a Freedom of Information Act request.

His comments went viral online and were widely criticized. In an e-mail sent to news outlets, Mr. Jones said he was speaking “off the cuff” and referring in particular to “global macro traders,” who work across multiple markets.

“Macro trading requires a high degree of skill, focus and repetition,” Mr. Jones said by way of clarification. “Life events, such as birth, divorce, death of a loved one and other emotional highs and lows are obstacles to success in this specific field of finance.” He added that success was possible “as long as a woman or man has the skill, passion, and repetitions to work through the inevitable life events that arise along the way.”

The episode was an uncomfortable turn for Mr. Jones, who earlier this month was called a “modern-day Robin Hood” by CBS News’s “60 Minutes” in a report on the financier’s charitable foundation.

Watching the video, there was a “pit in my stomach of how 1950s that is,” Alexandra Lebenthal, chief executive of the financial firm Lebenthal & Company, said on MSNBC’s “Morning Joe” on Friday.

“I’m not sure that bonding experience of breastfeeding is all that wonderful,” Ms. Lebenthal added.

Joanna Coles, editor in chief of Cosmopolitan, said on MSNBC: “What you see in this is actually what a lot of men on Wall Street still actually think.”

Mr. Jones’s theory is “scientifically unsound,” Simone Foxman said in Quartz. “Women don’t produce as much cortisol when in risky situations and therefore — theoretically at least — aren’t as likely to be as overwhelmed by negative emotions.”

My View is that there is some truth in it, but very little in effect. Let's be honest, Paul is not the person who created the financial trading system, he merely commented on the reality. Truth be told, most good traders who happen to be men, are also mostly dead inside. Nuff said. The ability to focus and block out other thoughts and considerations are paramount to be a great trader. Let's be frank, how many of us can do that without our minds wondering and wandering. Great traders usually have very empty lives, have to keep drowning their hollow soul with liquor and checking their bank balance gives them the kind of temporary adrenaline high to remind themselves falsely that what they are doing is worthwhile.

The reason why most great traders are men lies in the society structure and biases - men still have certain advantages in terms of "old boys network", and preferential treatment when hiring traders. The whole system is geared towards a brutal Darwinian elimination process. Only the good survive the industry. When you have 980 men and 20 women in trading positions to start with ... isn't it normal to see the top ten traders being largely men, maybe 9/10 or even 10/10.

For a billionaire hedge fund manager who carefully manages his public image, Paul Tudor Jones had a minor crisis on his hands. Mr. Jones, a billionaire and philanthropist of legendary stature in the minds of many Wall Street traders, was forced on Thursday to explain what he meant in remarks that surfaced in a video published by The Washington Post. The video, depicting a University of Virginia symposium in April, shows Mr. Jones trying to explain why there is a scarcity of female traders.

“As soon as that baby’s lips touch that girl’s bosom, forget it,” Mr. Jones, who has three daughters, says in the video. “Every single investment idea, every desire to understand what’s going to make this go up or go down, is going to be overwhelmed by the most beautiful experience, which a man will never share, about a mode of connection between that mother and that baby.”

“I’ve just seen it happen over and over,” he added. “I’m talking about trading, not managing.” The video was obtained through a Freedom of Information Act request.

His comments went viral online and were widely criticized. In an e-mail sent to news outlets, Mr. Jones said he was speaking “off the cuff” and referring in particular to “global macro traders,” who work across multiple markets.

“Macro trading requires a high degree of skill, focus and repetition,” Mr. Jones said by way of clarification. “Life events, such as birth, divorce, death of a loved one and other emotional highs and lows are obstacles to success in this specific field of finance.” He added that success was possible “as long as a woman or man has the skill, passion, and repetitions to work through the inevitable life events that arise along the way.”

The episode was an uncomfortable turn for Mr. Jones, who earlier this month was called a “modern-day Robin Hood” by CBS News’s “60 Minutes” in a report on the financier’s charitable foundation.

Watching the video, there was a “pit in my stomach of how 1950s that is,” Alexandra Lebenthal, chief executive of the financial firm Lebenthal & Company, said on MSNBC’s “Morning Joe” on Friday.

“I’m not sure that bonding experience of breastfeeding is all that wonderful,” Ms. Lebenthal added.

Joanna Coles, editor in chief of Cosmopolitan, said on MSNBC: “What you see in this is actually what a lot of men on Wall Street still actually think.”

Mr. Jones’s theory is “scientifically unsound,” Simone Foxman said in Quartz. “Women don’t produce as much cortisol when in risky situations and therefore — theoretically at least — aren’t as likely to be as overwhelmed by negative emotions.”

My View is that there is some truth in it, but very little in effect. Let's be honest, Paul is not the person who created the financial trading system, he merely commented on the reality. Truth be told, most good traders who happen to be men, are also mostly dead inside. Nuff said. The ability to focus and block out other thoughts and considerations are paramount to be a great trader. Let's be frank, how many of us can do that without our minds wondering and wandering. Great traders usually have very empty lives, have to keep drowning their hollow soul with liquor and checking their bank balance gives them the kind of temporary adrenaline high to remind themselves falsely that what they are doing is worthwhile.

The reason why most great traders are men lies in the society structure and biases - men still have certain advantages in terms of "old boys network", and preferential treatment when hiring traders. The whole system is geared towards a brutal Darwinian elimination process. Only the good survive the industry. When you have 980 men and 20 women in trading positions to start with ... isn't it normal to see the top ten traders being largely men, maybe 9/10 or even 10/10.

Thursday, May 23, 2013

The Silent Movie Man - Speaks For All

Everyone has seen some Charlie Chaplin movies, they were great and still are. That alone would have suffice in leaving a wonderful legacy of a life well lived. Not many has even heard of him speak, but if you watch his only snippet from The Great Dictator, where he spoke in his movie for the first and only time, ever ... you know he has an even greater soul. While disguised as part of a movie script, its blatantly obvious that he chose that one instance, that one platform to voice his important empathetic view - funny how much of that speech is still so relevant for so many people in so many places, ours included.

Good day to you, Sir Charlie Chaplin ....

Another example of his great talent, he composed the music to Smile ... Michael Jackson's favourite song of all time. Charlie Chaplin, a man so devoted to make us all laugh, must have known what hurt is to come up with these two important contributions during his life on earth.

Good day to you, Sir Charlie Chaplin ....

Another example of his great talent, he composed the music to Smile ... Michael Jackson's favourite song of all time. Charlie Chaplin, a man so devoted to make us all laugh, must have known what hurt is to come up with these two important contributions during his life on earth.

Wednesday, May 22, 2013

How to think about the future

Nesta has just released a video (below) of the event I did in London a few weeks ago with Nate Silver and others. It's a short discussion (5 minutes from each) on prediction and forecasting, followed by 45 minutes of (good) questions from the audience. My wife's opinion is that I spoke well but radiated unnecessary waves of negativity over the audience by emphasizing the limitations of prediction and the dangers that follow from believing you can predict when in fact you cannot. Maybe so! But sometimes I do like to be cautious...

Labels:

forecasting,

future,

london,

nate silver,

nesta,

prediction

Tuesday, May 21, 2013

Gotta Watch This - Miyoko Shida Rigolo

This is an exceptional piece of performance art. In fact, it is so much more than just exhibiting the powers of concentration. It is art definitely, loaded with meanings and inflections. The inter-connectedness of everything in life, its delicate balance ... seemingly unimportant (feather) yet it holds everything together. Its beautiful, moving and thought provoking.

Saturday, May 18, 2013

New Darling Stock In The Making?

Now we get an idea of whats been driving up the shares of Instacom. The Company also released its first quarter results last Tuesday with revenue of RM30.2m and PAT of RM6.8m. Annualising its PAT would yield a projected year end profits of RM27.2m.

At last Friday's close of 39.5c, that's a PE of 10 times, which for a growth stock in an exciting rapidly growing and constantly transforming telecommunications industry is fairly reasonable. Some may argue its still cheap as PE of 15 to 18 times is normally par for course for the Telco industry across the region. That would translate in to a price range of 58c to 68c.

This has not even factored in the earnings contribution from the RM205m as highlighted in the STAR or EDGE today yet. Potentially Instacom can be a GEM as a valued investment stock. You do the calculations and derive your own conclusion based on your risk averse outlook and your balanced portfolio considerations.

If you assume that it yields just 15% net margins over 3 years, that is RM30.75m or roughly an additional RM10m net a year.

Current number of 20 sen shares: 702.25m

For argument's sake, lets just take RM6m net per quarter, annualised = RM24m

Plus the new project = RM10m = RM34m

Net EPS = 4.8 sen

40 sen 8.3x

45 sen 9.3x

50 sen 10.4x

55 sen 11.4x

60 sen 12.5x

The other question is whether the project is a one off. If you look into the telcos' plans, there are nearly every single telco (Celcom, Maxis, DIGI, etc..) plans to spend an additional RM300m -RM1bn each over the next 12 months. It would be silly to think they would not be getting some of these as the company is heads and shoulders above the rest in its sub-industry in terms of time execution and delivery of projects.

The company could very well be the new darling stock for the rest of the year.

| Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions. | |||||||

Friday, May 17, 2013

Blind on purpose: equilibrium as a conceptual filter in economics

A couple of years ago, I came across this article written in The Huffington Post by economist and game theorist David Levine. It carried the provocative title "Why Economists Are Right," and argued back against all those who were then criticizing economics -- especially the rational expectations assumption -- in the aftermath of the financial crisis. Levine's article is delicately crafted and sounds superficially convincing. Indeed, it seems to make the rational expectations idea almost obvious. His argument is a masterpiece of showmanship in the manner of Milton Friedman -- its conclusion seems unavoidable, yet the logic seems somehow fishy, though in a way that is hard to pin down.

The most notable passage in this sense is the following:

When I first read this I thought -- well, he's just assuming that people will learn over time to hold rational beliefs. In other words, he simply asserts (maybe because he believes this) that the only possible outcome in our world has to be an equilibrium. If people have certain beliefs, and their actions based on these lead to a collective outcome that does not confirm those beliefs, then they'll have to adjust those beliefs. There's no equilibrium but ongoing change. From this, Levine assumes that if this goes on for a while that peoples' beliefs will adjust until they lead to actions and collective outcomes that confirm these beliefs and bring about an equilibrium. But this is simply his personal assumption, presumably because he likes game theory and has expertise in game theory and so likes to think about equilibria.

The world is much more flexible. The more general possibility is that people adjust their beliefs, act differently, and their collective behaviour leads to another outcome that against does not confirm their beliefs (at least not perfectly), so they adjust again. And there's an ongoing dance and co-evolution between beliefs and outcomes that never settles into any equilibrium.

But I've kept this essay in the back of my mind, never quite sure if my interpretation made sense, or if the hole in Levine's logic could really be this blazingly obvious. I'm now more strongly convinced that it is, in part because of a beautiful paper I came across yesterday by economist Brian Arthur. Arthur's paper is a wonderful review of the motivation behind complexity science and its application to economics. Two passages resonate in particular with Levine's argument about rational expectations:

One other final comment from Arthur, with which I totally agree:

The most notable passage in this sense is the following:

In simple language what rational expectations means is "if people believe this forecast it will be true." By contrast if a theory is not one of rational expectations it means "if people believe this forecast it will not be true." Obviously such a theory has limited usefulness. Or put differently: if there is a correct theory, eventually most people will believe it, so it must necessarily be rational expectations. Any other theory has the property that people must forever disbelieve the theory regardless of overwhelming evidence -- for as soon as the theory is believed it is wrong.Seems convincing, doesn't it? Or at least almost convincing. Is this the only claim made by the rational expectations assumption? If so, maybe it is reasonable. But there's a lot lurking in this paragraph.

When I first read this I thought -- well, he's just assuming that people will learn over time to hold rational beliefs. In other words, he simply asserts (maybe because he believes this) that the only possible outcome in our world has to be an equilibrium. If people have certain beliefs, and their actions based on these lead to a collective outcome that does not confirm those beliefs, then they'll have to adjust those beliefs. There's no equilibrium but ongoing change. From this, Levine assumes that if this goes on for a while that peoples' beliefs will adjust until they lead to actions and collective outcomes that confirm these beliefs and bring about an equilibrium. But this is simply his personal assumption, presumably because he likes game theory and has expertise in game theory and so likes to think about equilibria.

The world is much more flexible. The more general possibility is that people adjust their beliefs, act differently, and their collective behaviour leads to another outcome that against does not confirm their beliefs (at least not perfectly), so they adjust again. And there's an ongoing dance and co-evolution between beliefs and outcomes that never settles into any equilibrium.

But I've kept this essay in the back of my mind, never quite sure if my interpretation made sense, or if the hole in Levine's logic could really be this blazingly obvious. I'm now more strongly convinced that it is, in part because of a beautiful paper I came across yesterday by economist Brian Arthur. Arthur's paper is a wonderful review of the motivation behind complexity science and its application to economics. Two passages resonate in particular with Levine's argument about rational expectations:

One of the earliest insights of economics—it certainly goes back to Smith—is that aggregate patterns [in the economy] form from individual behavior, and individual behavior in turn responds to these aggregate patterns: there is a recursive loop. It is this recursive loop that connects with complexity. Complexity is not a theory but a movement in the sciences that studies how the interacting elements in a system create overall patterns, and how these overall patterns in turn cause the interacting elements to change or adapt. It might study how individual cars together act to form patterns in traffic, and how these patterns in turn cause the cars to alter their position. Complexity is about formation—the formation of structures—and how this formation affects the objects causing it.Here I think Arthur has perfectly described the limitation of Levine's position. Levine is happy with rational expectations because he is willing to restrict his field of interest only to those very few special cases in which peoples' expectations do correspond to collective outcomes. Anything else he thinks is uninteresting. I'm not even sure that Levine realizes he has so restricted his field of interest only to equilibrium, thereby neglecting the much larger and richer field of phenomena outside of it.

To look at the economy, or areas within the economy, from a complexity viewpoint then would mean asking how it evolves, and this means examining in detail how individual agents’ behaviors together form some outcome and how this might in turn alter their behavior as a result. Complexity in other words asks how individual behaviors might react to the pattern they together create, and how that pattern would alter itself as a result. This is often a difficult question; we are asking how a process is created from the purposed actions of multiple agents. And so economics early in its history took a simpler approach, one more amenable to mathematical analysis. It asked not how agents’ behaviors would react to the aggregate patterns these created, but what behaviors (actions, strategies, expectations) would be upheld by—would be consistent with—the aggregate patterns these caused. It asked in other words what patterns would call for no changes in micro-behavior, and would therefore be in stasis, or equilibrium. (General equilibrium theory thus asked what prices and quantities of goods produced and consumed would be consistent with—would pose no incentives for change to—the overall pattern of prices and quantities in the economy’s markets. Classical game theory asked what strategies, moves, or allocations would be consistent with—would be the best course of action for an agent (under some criterion)—given the strategies, moves, allocations his rivals might choose. And rational expectations economics asked what expectations would be consistent with—would on average be validated by—the outcomes these expectations together created.)

This equilibrium shortcut was a natural way to examine patterns in the economy and render them open to mathematical analysis. It was an understandable—even proper—way to push economics forward. And it achieved a great deal. ... But there has been a price for this equilibrium finesse. Economists have objected to it—to the neoclassical construction it has brought about—on the grounds that it posits an idealized, rationalized world that distorts reality, one whose underlying assumptions are often chosen for analytical convenience. I share these objections. Like many economists I admire the beauty of the neoclassical economy; but for me the construct is too pure, too brittle—too bled of reality. It lives in a Platonic world of order, stasis, knowableness, and perfection. Absent from it is the ambiguous, the messy, the real.

One other final comment from Arthur, with which I totally agree:

If we assume equilibrium we place a very strong filter on what we can see in the economy. Under equilibrium by definition there is no scope for improvement or further adjustment, no scope for exploration, no scope for creation, no scope for transitory phenomena, so anything in the economy that takes adjustment—adaptation, innovation, structural change, history itself—must be bypassed or dropped from theory. The result may be a beautiful structure, but it is one that lacks authenticity, aliveness, and creation.

Thursday, May 16, 2013

Finally, .... 101 Proposals

Finally, somebody has decided to remake my all time favourite TV series, the Japanese romantic comedy 101 Proposal. You will cry buckets and laugh like a lunatic if you have watched it before. The remake is a China production with Lin Chiling, whom I have never thought to be much of a talent, but did well. The always funny and self deprecating Bo Huang. To consolidate a TV series into a movie is never an easy task, but its pretty good.

If you have a few hours to spend, go watch the entire 12 episodes on You Tube. I have linked the first episode at the bottom (yes, got English subtitles).

The original 101st Marriage Proposal is a "Beauty and the Beast" story starring Takeda Tetsuya (Virgin Road, 3 nen B gumi Kinpachi Sensei) as a down-on-his-luck man who has gone through 99 omiai (arranged dates with the intention of marriage if the date goes well). Not particularly smart, nor handsome, nor rich, he is a man who cannot lie and of course, has a heart of pure gold. On the 100th omiai, he meets Kaoru (Asano Atsuko), an extremely beautiful and talented cellist who can't forget her dead fiancee.

So, Takeda has had 100 arranged dates with marriage in mind setting but its the 100th date that caused him to abandon the "arranged marriage" mentality and pursue true love and devotion. The entire series has him trying to pursue the girl and failing and failing, with comical results. Besides the many things that were seemingly incompatible, she cannot love again as she fears anyone she loves will die on her again like her fiancee. Why is the thing called 101 Proposals ... well ... the 101th proposal is by the girl asking Takeda to marry her, thats why.

Its such an iconic series helped by the ever brilliant Chage & Aska theme song Say Yes which can be heard throughout the series and also in the new Mandarin remake. A side note, am I the only one to notice that Takeda Tetsuya, the original lead, made a cameo appearance as the husband of the girl's teacher from Japan - what a gem of cinematic kismet.

The series was made back in 1991 ... but you can certainly see and count how many more recent movies have stolen ideas left right and center from the series ... HK, China, Korea, America...

If you do not have the time to watch the movie or the series, well at least watch the final 14 minutes of the original series ending as they provide the entire flashback of the courtship and ending. The series is infinitely better as its like 12 movies, and there are many great relationships .... the most touching is between Takeda and his good looking brother.

Watch the whole original series, start with Episode 1, there are 12. If English subtitles are not showing, look for the Caption button and turn to English.

Wednesday, May 15, 2013

The European transactions tax -- an act of pure hope?

My latest column in Bloomberg came out about a week ago. Forgot to mention it. The story is this: The European Commission has very firm plans to introduce a financial transactions tax -- a "Tobin" style tax -- on most financial transactions at the beginning of January 2014. That's just over 6 months away. I was surprised to learn they were taking this step, as I thought that very little was really known about the likely consequence of such a tax, especially introduced on such a grand scale. So, I spent a week or so looking into all the research I could find on financial transactions taxes, theoretical and empirical, and came to the conclusion that -- indeed, very little is known. But Europe is going ahead anyway!

If anyone wants to look at some of the original research, I suggest having a look at the following few things. First, the best overall review is this one by Neil McCulloch and Grazia Pacillo of the University of Sussex. Their conclusion is, in two sentences, that...

Other important studies are this one by Westerhoff and Pellizzari which uses an agent based market model to test how the consequences of a transactions tax might depend on market microstructure. I think this is among the most sophisticated studies done to date (although it can still be improved in many ways and represents a beginning, not an end). There's also an older review from 1993 by Schwert and Seguin that I read and which is useful (sadly, I'm not sure where the link is.... I have a pdf and found it by googling, that's all I can say). Finally, if you have the brave heart to read the original impact assessment of the EC proposal for the tax, it is here. That report doesn't actually mention any research on how the tax will likely influence markets, but only looks at how the macroeconomy might be effected.

If anyone wants to look at some of the original research, I suggest having a look at the following few things. First, the best overall review is this one by Neil McCulloch and Grazia Pacillo of the University of Sussex. Their conclusion is, in two sentences, that...

We conclude that, contrary to what is often assumed, a Tobin Tax is feasible and, if appropriately designed, could make a significant contribution to revenue without causing major distortions. However, it would be unlikely to reduce market volatility and could even increase it.But if you read the report, you'll see that the outcome seems very likely to depend on fine details of how the tax is implemented and of the markets to which it is applied.

Other important studies are this one by Westerhoff and Pellizzari which uses an agent based market model to test how the consequences of a transactions tax might depend on market microstructure. I think this is among the most sophisticated studies done to date (although it can still be improved in many ways and represents a beginning, not an end). There's also an older review from 1993 by Schwert and Seguin that I read and which is useful (sadly, I'm not sure where the link is.... I have a pdf and found it by googling, that's all I can say). Finally, if you have the brave heart to read the original impact assessment of the EC proposal for the tax, it is here. That report doesn't actually mention any research on how the tax will likely influence markets, but only looks at how the macroeconomy might be effected.

The real worry over Europe...

What's the most important thing to worry about in Europe - or with the economic crisis more generally? I think for many people -- especially economists of the Chicago school -- the biggest concern is that we might lose a couple of percentage points of cherished growth over the next ten years, leading to a tragic loss of GDP relative to where we might have been. But the really important thing about this crisis isn't about money or wealth, but about social stability. George Soros, as usual, sees more clearly than others:

Soros also has a few thoughts on austerity:

I have been very concerned about Europe. The euro is in the process of destroying the European Union. To some extent, this has already happened, in the sense that the EU was meant to be a voluntary association of equal states. The crisis has turned it into something that is radically different: a relationship between creditors and debtors. And, in a financial crisis, the creditors are in charge. It is no longer a relationship between equals. The fate of Italy, for example, is no longer determined by Italian politics – which is in a crisis of its own, I would say – but rather by the creditor/debtor relationship. That is really what dictates policies.The point is that this European crisis is NOT JUST a financial crisis. It is much more serious than that. It's a political and social crisis. We talk about it in financial terms, but the really important thing is a massive breakdown in cooperation and political function, obviously in Europe, but elsewhere as well. A few years ago, the idea of a global financial crisis seemed pretty hard to imagine. What are we failing to imagine now?

Soros also has a few thoughts on austerity:

The evidence is growing that austerity is not working. Sooner or later, I expect a reversal of the current fiscal policy – the sooner, the better. There is a political problem, namely that the creditors dictate economic policy. And there is a financial or an economic problem, namely that the policy the creditors advocate is counter-productive. The rest of the world, in the face of excessive unemployment, is no longer trying to reduce prematurely government debt accumulated during the financial crisis. And the rest of the world engages in quantitative easing. The latest convert is Japan, where the central bank has been forced to abandon its orthodox monetary policy. So I think it is only a matter of time. Something has to give in Europe, because Europe is out of touch, out of synch, with the rest of the world.

Tuesday, May 14, 2013

Instacom, Garnering Good Interest

The company was listed via a RTO last year and had stayed relatively quiet for some time. What was interesting was that the company's share price started edging up even before the recent elections was over. To do that, I think the buyers must be confident of the prospects for the company. It has continued to move upwards and appears to be consolidating its gains for the past couple of days.

Last night, Instacom Group Berhad (IGB)’s financial performance continued where it left off from the last quarter to record continued strong growth during the first quarter of 2013. In an announcement to Bursa Malaysia this evening, IGB said that, for the current financial quarter ended 31 March 2013, the Group recorded revenue of RM30.210 million and profit before tax of RM6.828 million. Against the previous corresponding period, these numbers represent significant increases of RM29.350 million and RM9.895 million, respectively.

The earnings jump is significant as the company had guaranteed at least RM15m in profits following the RTO exercise. It looks likely that that figure will be easily breached.

Besides being probably the best telco backend infra company, the company has its roots in East Malaysia, which should see a substantial deployment of investment to further enhance the connectivity and penetration in East Malaysia, hence they should be a prime beneficiary there.

Another aspect which they are currently looking at is the potential to move into ownership of telecom assets. They are looking into a tower REIT as an option. They have already started acquiring such assets and should make an announcement to monetise them in the near future.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Last night, Instacom Group Berhad (IGB)’s financial performance continued where it left off from the last quarter to record continued strong growth during the first quarter of 2013. In an announcement to Bursa Malaysia this evening, IGB said that, for the current financial quarter ended 31 March 2013, the Group recorded revenue of RM30.210 million and profit before tax of RM6.828 million. Against the previous corresponding period, these numbers represent significant increases of RM29.350 million and RM9.895 million, respectively.

IGB Chief Executive Officer Anne Kung described the Q1 financial performance as “sterling and reflects how hard we are working in our quest for operational excellence and maximizing returns for all shareholders.”

The telecommunications industry is growing in leaps and bounds as Malaysia moves into the LTE (long term evolution) era with major operators looking to expand their data earnings. Mobile data traffic in Malaysia should double this year in line with the global trend,” she said, quoting a recent report by telecoms equipment firm Ericsson which foresees mobile data volumes rising by a compound annual growth rate of around 50% between 2012 and 2018.

The earnings jump is significant as the company had guaranteed at least RM15m in profits following the RTO exercise. It looks likely that that figure will be easily breached.

Besides being probably the best telco backend infra company, the company has its roots in East Malaysia, which should see a substantial deployment of investment to further enhance the connectivity and penetration in East Malaysia, hence they should be a prime beneficiary there.

Another aspect which they are currently looking at is the potential to move into ownership of telecom assets. They are looking into a tower REIT as an option. They have already started acquiring such assets and should make an announcement to monetise them in the near future.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Event coming up in Oxford... 4 June

For anyone who is interested, I will be in Oxford in two weeks speaking along with Doyne Farmer at the above public event. Should be interesting. Organized by the Institute of Physics.

Monday, May 13, 2013

Stocks To Watch

The market has been trying to fill the gap to its recent high. Local investors are putting their money to work. The prevailing themes are still oil and gas and Iskandar as expected. However we cannot be buying each and every share that moves. Here are a few for your consideration. Nobody should be bitching about the price chart trend, of course its up already. No point looking at laggards, not their time yet plus the market has not reached a level whereby we should be looking at laggards yet.

Hiap Teck - Good volume formation.

Wah Seong - This one got some legs even though the spike has been significant. Instead of looking at the beneficiaries of marginal oil fields contracts, one should really look at pipe coating specialist such as Wah Seong, under the radar for too long.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Hiap Teck - Good volume formation.

Wah Seong - This one got some legs even though the spike has been significant. Instead of looking at the beneficiaries of marginal oil fields contracts, one should really look at pipe coating specialist such as Wah Seong, under the radar for too long.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

Saturday, May 11, 2013

Why Khalid For MB Selangor

Tan Sri Khalid may not be as charismatic as many other seasoned politicians, his contribution is to run Selangor state coffers in a most prudent way. There are many things a MB cannot do if they are under the purview of the Federal government - e.g. the Police on crime rates, tax rates for various things ... I do think he should come down harder on a lot of shenanigans still in the local councils, city councils, etc...

Friday, May 10, 2013

What has"econophysics" achieved?

Research in so-called "econophysics" -- the application of ideas and concepts from physics to problems in finance and economics -- tends to be quite controversial. Many economists in particular seem to find it fairly annoying, although quite a few others either work in the area or do work that is closely associated in conceptual terms. Physicists in the area have been criticized on various occasions for being ignorant of prior work in economics (sometimes true), of using less than rigorous statistics (I haven't seen anything convincing on this) and of employing unrealistic models.

There is plenty of uninspiring work in the field, as in any area of science. Out of politeness, and to avoid boring anyone, I won't make a list. But physicists have made quite a number of lasting contributions to a deeper understanding of finance and economics; in some cases, I think, they have helped to change the direction of research in economics. So I thought it might be worth making a short list of the things that I think have indeed been success stories. Here goes:

1. More than anything, physicists have helped to establish empirical facts about financial markets; for example, that the probability of large market returns decreases in accordance with an inverse cubic power law in many diverse markets. This seems to be a universal result, at least approximately. I've written about this work here. Work by physicists has also established other generic market patterns such as the self-similar structure of market volatility. I very nice review of these patterns is this one by Lisa Borland and colleagues.

Now, did econophysicists initiate this kind of work? Of course not. Benoit Mandelbrot found the first evidence for fat tailed distributions in the early 1960s (and Eugene Fama even wrote about that work in his first paper!). But research by physicists has made our knowledge of these empirical regularities much more precise.

2. Physicists have also identified instructive links between markets and other natural phenomena. For example, in the period following a large market crash, markets show lingering activity which follows the famous Omori law for earthquake aftershocks (events become less likely in simple inverse proportion to the time after the main shock). Such connections indicate that the explanation of such market dynamics may well not depend on facts specific to finance and economics; that more general dynamical principles may be involved.

3. Physicists have also helped develop more realistic models of markets, here mostly in collaboration with economists. In the mid-1990s, researchers at the Santa Fe Institute first demonstrated how fat-tailed dynamics could arise naturally in models representing a market as an ecology of interacting adaptive agents. Models of this kind have since become widespread and used to perform some of the most sophisticated tests of policy proposals -- for the idea of a financial transactions tax, for example, as currently planned by the European Commission. For this, econophysics deserves some credit. For a nice review, see this paper by economist Blake Lebaron (I've summarized it here).

If you doubt that the early work at Sante Fe had a real effect on encouraging this work, pushing the study of computational models of heterogeneous adaptive interacting agents to the forefront of market modelling, take a look at this 2002 review by economist Cars Hommes. As seminal work in this area, he cites papers in the early 1990s by Alan Kirman, by Brad DeLong and colleagues and by the group at Santa Fe which involved a key collaboration between economists and physicists. This work helped kick off, as he describes it, a transformation (still ongoing) of style in modelling markets:

In the past two decades economics has witnessed an important paradigmatic change: a shift from a rational representative agent analytically tractable model of the economy to a boundedly rational, heterogeneous agents computationally oriented evolutionary framework. This change has at least three closely related aspects: (i) from representative agent to heterogeneous agent systems; (ii) from full rationality to bounded rationality; and (iii) from a mainly analytical to a more computational approach...

Hommes makes it sound here as if this transformation and paradigm shift is now widely accepted in economics. I'm not so sure about that as there still seem to be plenty of people eagerly working away on rational representative agent models.

4. Work in econophysics -- through the study of minimal models such as the minority game -- has also revealed surprising qualitative features of markets; for example, that a key determinant of market dynamics is the diversity of participants' strategic behaviour. Markets work fairly smoothly if participants act using many diverse strategies, but break down if many traders chase few opportunities and use similar strategies to do so. Strategic crowding of this kind can cause an abrupt phase transition from smooth behaviour into a regime prone to sharp, virtually discontinuous price movements.

If this point seems esoteric, one fairly recent study found more than 18,000 instances over five years where a stock price rose or fell by roughly 1% or more in well under a tenth of a second. These "glitches" or "fractures" may signal a transition of markets into a regime dominated by fast algorithmic trading. As algorithms compete on speed, they naturally rely on simple strategies, which encourages strategic crowding. The underlying phase transition phenomenon may therefore be quite relevant to policy. I know of nothing in traditional economic analysis that describes this kind of phase transition or does anything to elucidate the kinds of conditions under which it might take place.

5. Yale economist John Geanakoplos has argued for two decades that a key variable driving major economic booms and busts is the amount of leverage used by financial institutions. It goes up in good times, down in bad. Since the financial crisis, controlling leverage has become a major new focus of financial regulators, and their work may well benefit from physics-inspired models of the dynamics of markets in which firms compete with one another through the use of leverage. A notable study by Geanakoplos and two physicists found that such a market will naturally become unstable as leverage increases beyond a threshold. This boundary of instability is not at all obvious to market participants or made evident by standard economic theories. Such models may well help improve macroeconomic policy and financial regulation (I've written a little more on this here).

6. Physicists have also helped clarify other fundamental sources of market instability. For example, standard thinking in economics holds that the sharing of risks between financial institutions -- through derivatives and other instruments -- should both make individual firms safer and the entire banking system more stable. However, a collaboration of economists and physicists recently showed that too much risk sharing in a network of institutions can decrease stability. (Some discussion of this work here.) An over-connected network makes it too easy for trouble originating in one place to spread elsewhere. Again, this work involves an important collaboration between economists and physicists.

7. On a similar theme, fundamental analysis by econophysicists has examined the relationship between market efficiency and stability. In economic theory, markets become more efficient -- more able to pool collective wisdom and price assets accurately -- as they become more "complete," i.e. equipped with such a broad range of financial instruments that essentially any trade can be undertaken. The econophysics work has shown, however, that completeness brings with it inherent market instability, a possibility never raised (to my knowledge) by standard economic analyses.

8. The complexity of today’s markets makes is essentially impossible for financial institutions to judge the risks they face, as the health of any decent-sized financial institution depends on a vast web of links to other institutions about which little may be known. To improve risk judgement, econophysicists have recently developed a network measure called DebtRank which aims to cut through network complexity and reveal the true riskyness of any particular institution. This idea may also provide a natural means for making markets more stable, for if regulators made DebtRank results public, then anyone would, at a glance, gain a much more accurate view of the true risks associated with any bank. If banks seeking to borrow funds were forced to do so from the least risky banks, systemic instability would be improved. This is, for now, a highly speculative idea, but one that clearly has promise.

So there -- a list of 8 specific areas where I think econophysics has had an important impact on economics and finance. This is, as I said, a very short list, and of course reflects only my limited view. It also reflects limitations on how much I can write in one sitting, as there are clearly other notable achievements such as recent theories of market impact -- here and here, for example -- which make significant steps toward explaining how much prices change when someone sells an asset. I haven't mentioned applications of random matrix theory which cast serious doubt over how much empirical calculations of stock correlations really imply about the true correlations between those assets (undermining Markowitz portfolio theory). Then there's an entire field of work exploring how firm growth rates scale with firm size and what might account for this.

All of which suggests, to my mind, that econophysics has been a very valuable development indeed.

Labels:

controversy,

econophysics

Thursday, May 9, 2013

You do live on another planet -- evidence from the SEC

It seems that famed hedge fund manager Philip Falcone has, in principle, agreed to terms with the SEC in the case in which he was accused of "manipulating the market, using hedge fund assets to pay his taxes and “secretly” favoring select customers at the expense of others." Not surprisingly, as this is the SEC we're talking about, the agreement included the usual weasel clause letting the defendant admit no guilt. But it gets even better.

If you want evidence that the SEC was really determined to bend over backward on this one, how about the fact that the agreement didn't even include the usual statement, by the defendant, not to commit fraud in the future:

If you want evidence that the SEC was really determined to bend over backward on this one, how about the fact that the agreement didn't even include the usual statement, by the defendant, not to commit fraud in the future:

The settlement deal... is also notable for something that it did not include: a common provision that prohibits defendants from committing future violations with fraudulent intent. The lack of a so-called fraud injunction is an unusual victory for the target of an S.E.C. action.You may wonder why it even makes sense to include a clause prohibiting a defendant from committing future fraudulent acts, as fraud is already illegal. And just being a citizen essentially means you've agreed to it. Apparently, this clause makes it easier to prosecute future cases (the court can hold the defendant in contempt of court, at least in principle, for violating the law even after telling the court that he wouldn't). But here we have the SEC going to extra lengths not to make Mr. Falcone make such a terrible promise.

Questioning conventional wisdom

I recommend this fascinating interview with Harvard development economist Dani Rodrik. In his own words, he is someone who has worked from within the economic mainstream (especially where methods are concerned) but has not been afraid to accept logical conclusions that go against conventional wisdom, which is often not actually supported by any logic or theory. As he says,

This is an interesting point. In essence, he is suggesting that some of the policy conclusions generally supported by the economic mainstream (deregulation, more markets, etc.) actually find no real foundation in theory. Yet many economists support these conclusions anyway for other reasons. He goes on to talk about the social forces within the profession:...where I tend to part company with many of my colleagues is with the policy conclusions I reach. Many of my colleagues think of me as excessively dirigiste, or perhaps anti-market. A colleague at Harvard’s Economics Department would greet me by saying “how is the revolution going?” every time he saw me. A peculiar deformation of mainstream economics is the tendency to pooh-pooh the real-world relevance of all the theoretical reasons market fail and government intervention is desirable.This sometimes reaches comical proportions. You get trade theorists who have built their entire careers on “anomalous” results who are at the same time the greatest defenders of free trade. You get growth and development economists whose stock in trade are models with externalities of all kinds who are stern advocates of the Washington Consensus. When you question these policy conclusions, you typically get a lot of hand-waving. Well, the government is corrupt and in the pockets of rent-seekers. It does not have enough information to undertake the right kinds of interventions anyhow. Somehow, the minds of these analytically sophisticated thinkers turn into mush when they are forced to take seriously the policy implications of their own models.

Now, Rodrik does suggest that he likes to work within this framework for various reasons. But what he then says is most interesting, touching back on the point of how widely held policy views link back to actual economic theory. Often, he suggests, they have no foundation at all in such theory, which is often employed more as a rhetorical tool than anything else:There are powerful forces having to do with the sociology of the profession and the socialization process that tend to push economists to think alike. Most economists start graduate school not having spent much time thinking about social problems or having studied much else besides math and economics. The incentive and hierarchy systems tend to reward those with the technical skills rather than interesting questions or research agendas. An in-group versus out-group mentality develops rather early on that pits economists against other social scientists. All economists tend to imbue a set of values that tends to glorify the market and demonize public action.What probably stands out with mainstream economists is their awe of the power of markets and their belief that the market logic will eventually vanquish whatever obstacle is placed on its path. As a result, economists tend to look down on other social scientists, as those distant, less competent cousins who may ask interesting questions sometimes but never get the answers right. Or, if their answers are right, they are so not for the methodologically correct reasons. Even economists who come from different intellectual traditions are typically treated as “not real economists” or “not serious economists.”So the hurdles for the economists that want to depart from the conventional path are pretty high. Above all, they must play by the methodological rules of the profession. That means using the language of mathematics, the standard optimizing, general-equilibrium frameworks, and the established econometric tools. They must pay their dues and demonstrate they remain card-carrying members in good standing.

In my own case, every piece of conventional wisdom I challenged had already become a caricature of what sounds economics teaches us. I wasn’t doing anything more than reminding my colleagues about standard economic theory and empirics. It was like pushing on an open door. I wasn’t challenging the economics, but the sociology of the profession. For example, when I first began to criticize the Washington Consensus, I thought I was doing the obvious. The simple rules-of-thumb around which the Consensus revolved had no counterpart in serious welfare economics. Neither were they empirically well supported, in view of East Asia’s experience with heterodox economic models. When you questioned supporters closely, you first got some very partial economic arguments as response, and then as a last resort some political hand-waving (e.g., “we need to get the government to stop doing such things, otherwise rent-seeking will be rife…”). My argument was that we should take economics (and political economy) more seriously than simply as rules of thumb. Economics teaches us to think in conditional terms: different remedies are required by different constraints. That way of thinking naturally leads us to a contextual type of policy-making, a diagnostic approach rather than a blueprint, kitchen-sink approach.Similarly, when I questioned some of the excessive claims on the benefits of globalization I was simply reminding the profession what economics teaches. Take for example the relationship between the gains from trade and the distributive implications of trade. To this day, there is a tendency in the profession to overstate the first while minimizing the second. This makes globalization look a lot better: it’s all net gains and very little distributional costs. Yet look at the basic models of trade theory and comparative advantage we teach in the classroom and you can see that the net gains and the magnitudes of redistribution are directly linked in most of these models. The larger the net gains, the larger the redistribution. After all, the gains in productive efficiency derive from structural change, which is a process that inherently creates gainers (expanding sectors and the factors employed therein) and losers (contracting sectors and the factors employed therein). It is nonsensical to argue that the gains are large while the amount of redistribution is small – at least in the context of the standard models. Moreover, as trade becomes freer, the ratio of redistribution to net gains rises. Ultimately, trying to reap the last few dollars of efficiency gain comes at the “cost” of significant redistribution of income. Again, standard economics.Saying all this doesn’t necessarily make you very popular right away. I remember well the reception I got when I presented my paper (with Francisco Rodriguez) on the empirics of trade policy and growth. The literature had filled up with extravagant claims about the effect of trade liberalization on economic growth. What we showed in our paper is that the research to date could not support those claims. Neither the theoretical nor empirical literature indicated there is a robust, predictable, and quantitatively large effect of trade liberalization on growth. We were simply stating what any well-trained economist should have known. Nevertheless, the paper was highly controversial. One of my Harvard colleagues asked me in the Q&A session: “why are you doing this?” It was a stunning question. It was as if knowledge of a certain kind was dangerous.Years earlier, when I wrote my monograph Has Globalization Gone Too Far? I had been surprised at some of the reaction along similar lines. I expected of course that many policy advocates would be hostile. But my arguments were, or so I thought, based solidly on economic theory and reasoning. A distinguished economist wrote back saying “you are giving ammunition to the barbarians.” In other words, I had to exercise self-censorship lest my arguments were used by protectionists! The immediate qestion I had was why this economist thought barbarians were only on one side of the debate. Was he unaware of how, for example, multinational firms hijacked pro-free trade arguments to lobby for agreements – such as intellectual property – that had nothing to do with free trade? Why was it that the “barbarians” on one side of the issue were inherently more dangerous than the “barbarians” on the other side?But ultimately, the reward of challenging conventional wisdom that has gone too far is that you are eventually proved right. The Washington Consensus is essentially dead, replaced by a much more humble approach that recognizes the importance of locally binding constraints. And many of the arguments I made about the contingent nature of the benefits from trade and financial globalization are much closer to the intellectual mainstream today than they were at the time.

Alex Ferguson, Thank You Sir

Ferguson first few years were dicey, much like the first few years experienced by the last 5 Liverpool managers. In actual fact, he was almost booted but turned a corner and has not looked back since then. Continuity is so important and valued in being a football manager, something the modern game can no longer afford, or rather the owners cannot afford. Show me the results within 2-3 seasons or you are out. Molding a team requires time and in Ferguson's case his strategy was most prominent in the way he used the youth system, making it a celebrated channel for bringing up local talents.

In the present days of money buying talent strategy, Manchester United is Manchester United because we can proudly claim a large contingent of home grown talents and still a significant portion of players from the UK, something A LOT of teams cannot claim. At one stage, I though Liverpool was going to change name to Liverpool-Herzagovina.

The New Guy

The bookmakers is giving it to David Moyes, who, I must say has done wonderfully well with a limited budget and slightly above average team. He has shown that he can stick to it for some time. We should want someone who will stay around for at least 10 years. For Manchester United, its not just a manager we hire but a critical new family member.

But my preferred choice from day one has always been Martin O Neil, I think he is a bit more colourful and quite brilliant a manager.

In the present days of money buying talent strategy, Manchester United is Manchester United because we can proudly claim a large contingent of home grown talents and still a significant portion of players from the UK, something A LOT of teams cannot claim. At one stage, I though Liverpool was going to change name to Liverpool-Herzagovina.

The New Guy

The bookmakers is giving it to David Moyes, who, I must say has done wonderfully well with a limited budget and slightly above average team. He has shown that he can stick to it for some time. We should want someone who will stay around for at least 10 years. For Manchester United, its not just a manager we hire but a critical new family member.

But my preferred choice from day one has always been Martin O Neil, I think he is a bit more colourful and quite brilliant a manager.

Wednesday, May 8, 2013

Stocks To Watch

Its a new investment platform following the stop-start-maybe-cautious few months leading up to the elections. As mentioned during the S&M show, there are three tiers in the market, one is the blue blue chips, the second are the stocks that will benefit with the surrounding and prevailing market themes and the third are the fresh names coming up as they may benefit from new projects and investments by states and federal government.

MRCB - Going places, after years of being the neglected child of a large family, this kid is on the way up. EPF's Sungai Buloh project could involve MRCB in a major way.

WCT - Astute operator, like the way they think in hiving off part of the business to do value add. Will be a better and bigger player to watch.

MUHIBBAH - Despite the enormous near limit up surge a couple of months back, this company has more than turned a corner. Many funds are busy accumulating.

INSTACOM - Probably the best backend telco infrastructure player. Tons of work still needs to be done in East Malaysia's connectivity, will be a rising star. Build up in Volume indicates good following.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

MRCB - Going places, after years of being the neglected child of a large family, this kid is on the way up. EPF's Sungai Buloh project could involve MRCB in a major way.

WCT - Astute operator, like the way they think in hiving off part of the business to do value add. Will be a better and bigger player to watch.

MUHIBBAH - Despite the enormous near limit up surge a couple of months back, this company has more than turned a corner. Many funds are busy accumulating.

INSTACOM - Probably the best backend telco infrastructure player. Tons of work still needs to be done in East Malaysia's connectivity, will be a rising star. Build up in Volume indicates good following.

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.

IDEAS' View Of Elections - "Partially free and not fair"

WAS GE13 FREE AND FAIR?

IDEAS was accredited by the Election Commission of Malaysia (EC) to observe the recently concluded 13th General Elections. Our mandate was to observe, record, analyse and report events leading up to GE13, and subsequently recommend ways to improve any weaknesses found. We benchmarked our observation against the Inter-Parliamentary Union’s Declaration on Criteria for Free and Fair Elections. We deployed 325 observers to 99 parliamentary constituencies in Peninsula Malaysia and 6 overseas polling centres.

Generally, we found that EC successfully ensured the overall process between nomination day and election day proceeded smoothly without any major glitches. Complaints have been filed about the possibility of phantom voters and the failure of the indelible ink to work as it should. Both are important issues that must be addressed. However, we position these two issues in the context of the wider lack of trust in the integrity of the electoral roll, instead of simply a weakness of the EC. In order to address the root cause of the problem, serious attention must be given to improving the integrity of the electoral roll. This involves improving the integrity of the National Registration Department’s database, which may not be within the EC’s purview.

It is important to examine the events building up to GE13 in order to get a better perspective. Taking a long-term view, we saw that (1) The media was heavily biased in favour of Barisan Nasional. State-funded media platforms have been abused to project partisan views to the public; (2) There were doubts about the EC’s impartiality and competency despite their many efforts to improve the electoral system. They were seen as being part of an already biased civil service. The fact that EC members repeatedly issued statements that could be construed as partisan did not help. Their defensiveness when criticised further angered the public; (3) Trust in the integrity of the electoral roll is low. This resulted in the public being very cautious when there were reports of foreigners being flown in, when they saw foreign-looking individuals, or when the indelible ink was seen as ineffective; (4) The Registrar of Societies did not treat all political parties equally, delaying the registration process of non-BN partie; (5) Constituency sizes are too unequal, allowing parties that win many smaller seats to win parliament, despite not commanding popular support; (6) Financing of political parties is not transparent, resulting in a big lack of clarity about the financial standing of the competing parties; (7) During the campaigning period, government and armed forces facilities were repeatedly used for campaigning purposes during the official campaign period; (8) Racial issues were dangerously exploited for political gains. There were many instances of BN fishing for votes by sowing mistrust between the Chinese and Malay communities.

Therefore, although the official campaign period and electoral processes may have proceeded smoothly and with minimal major issues, wider issues that are not within the EC’s purview have built up over the last few years. These issues conspired against non-BN parties, therefore creating a very uneven field. Due to these reasons, we conclude that GE13 was only partially free and not fair.

Tuesday, May 7, 2013

S&M Show Podcasts

This week's topics: equity strategy after election, first tier, second tier and even third tier stocks

http://www.bfm.my/snm-show.html

http://www.bfm.my/snm-show.html

What It Means To Be A Leader & Servant of The People

Can everyone agree that politicians are servants for the people, elected by the people ... can all parties agree on that point? OK, let's move on ... so if there is a WAVE, be it Chinese, rural, Indian, Iban, retards, gays, mixed parentage, single mums ... any kind of WAVE la ... that voted against your PARTY ...

WHY DO YOU AS A LEADER/SERVANT/PARTY FOR THE PEOPLE ... IMMEDIATELY QUESTION THE LOYALTY, QUESTION THE DECISION, CLAIMS THAT THE PEOPLE PART OF THE WAVE WERE UNGRATEFUL???

If your party/leader/members were really servants for the people .... the first thing that should come to your mind is .. WHERE DID WE GO WRONG!!! ... and not point fingers at your citizens!!!

When you accuse, it shows where your heart, motivations and intentions are ...

Why don't you be a servant of the people as all politicians should be, and ask the party themselves "DI MANA KAH KITA DAH MENGECEWAKAN RAKYAT ... menjadikan keadaan begini .... kenapa ada sekelompok rakyat yang berfikir demikian"

(Where did we go wrong, where did we fail our people that caused this group of people to vote against us)

WHY DO YOU AS A LEADER/SERVANT/PARTY FOR THE PEOPLE ... IMMEDIATELY QUESTION THE LOYALTY, QUESTION THE DECISION, CLAIMS THAT THE PEOPLE PART OF THE WAVE WERE UNGRATEFUL???

If your party/leader/members were really servants for the people .... the first thing that should come to your mind is .. WHERE DID WE GO WRONG!!! ... and not point fingers at your citizens!!!

When you accuse, it shows where your heart, motivations and intentions are ...

Why don't you be a servant of the people as all politicians should be, and ask the party themselves "DI MANA KAH KITA DAH MENGECEWAKAN RAKYAT ... menjadikan keadaan begini .... kenapa ada sekelompok rakyat yang berfikir demikian"

(Where did we go wrong, where did we fail our people that caused this group of people to vote against us)

Lots Of Questions, No Answers

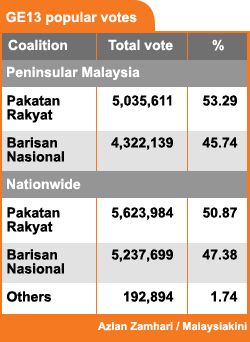

The chart above is why so many questions have risen ....

Bridget Welsh also has her view on the situation below.

Disturbing questions surrounding GE13 polling

By Bridget Welsh | 12:05PM May 7, 2013

Malaysiakini

Malaysiakini

GE13 SPECIAL The GE13 results are in and the BN has managed to hold only power, winning by a 22-seat majority. This result is the worst performance for BN in Malaysia’s history.

GE13 SPECIAL The GE13 results are in and the BN has managed to hold only power, winning by a 22-seat majority. This result is the worst performance for BN in Malaysia’s history.For the first time, the incumbent government has lost the popular vote nationally (in 2008, it was only on the peninsula). The BN coalition has still managed to hold onto power. This piece, in a series analysing the election results, looks at the concerns raised regarding the electoral process and the potential impact these issues may have had on the final results.

In analysing the fairness of any polls, one asks whether the irregularities in the process could have affected the final outcome. Were the problems enough to change which coalition would have formed government? These issues will be debated and assessed in the days and weeks ahead. Let me share some preliminary observations that suggest that in this election, some things appear not to be quite right.

Integrity of electoral roll

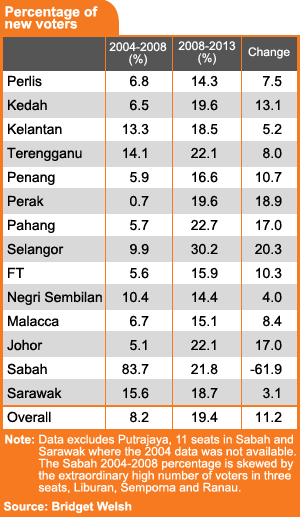

This was the longest wait for an election, and both sides were extremely active in registering new voters, especially in the urban areas where the party machinery was well honed.

Even factoring in the more robust voter registration efforts, changes in electoral procedures to register people where they live rather than where they are from, population demographics, and possible housing developments in different seats, the increased numbers in the electoral roll are significantly not in line with historical patterns of voter registration. This out-of-line pattern is in every state, except Negeri Sembilan.

Even factoring in the more robust voter registration efforts, changes in electoral procedures to register people where they live rather than where they are from, population demographics, and possible housing developments in different seats, the increased numbers in the electoral roll are significantly not in line with historical patterns of voter registration. This out-of-line pattern is in every state, except Negeri Sembilan.

The figure that stands out in voter increase occurred from 2004 to 2008 in Sabah. The questions about the electoral roll in Sabah have been long standing, and are the subject of the ongoing Royal Commission of Inquiry into Immigrants.

These increases from 2004 through 2008 are by any measure – huge – in places such as Liburan, where caretaker Chief Minister Musa Aman state seat is located, in Semporna, the seat of Shafie Apdal and in Ranau currently held by Ewok Ebin.

Yet, after 2008, while the numbers have dropped, there is still on average 21% new voters in Sabah seats, a high number not in line with demographic trends. Migration appears to continue be a factor shaping voter numbers in Sabah in this GE13, despite calls to tighten the flows.

We also find that new voters have flooded states like Selangor, Pahang, Terengganu and Johor in GE13. The average increase in voters nationally between 2004 and 2008 was 8.2%. In the run-up to GE13, the voters registered doubled to 19.4%. The national and statewide averages however obscure the differences among different seats within states. It is clear that some seats have been special recipients of new voters.

Much has been made of the 28% of new voters in Lembah Pantai. This seat is actually on the low side compared to others. Consider the whopping 61.5% increase in Tapah, recently re-won by BN, or Subang with 52% new voters, won by Pakatan with a larger majority this election but shaped heavily by Pakatan’s registration of new voters.

A total of 90 seats, or 41% of all parliamentary seats, have more than 25% new voters. Many of these were in races with tight contests in 2008, and continued to have tight contests in GE13. The new voters has advantaged the opposition in urban areas, but benefitted the BN in rural and semi-rural areas or in states where the machinery of the opposition is comparatively weak, such as Johor.

Such races also won by BN that had large number of voters include Cameron Highlands (20%), Pasir Gudang (39%) and Tebrau (45%) in Johor. While some of the increase in the latter two seats might be explained in part by development, bizarrely there are sharp increases in voting populations in the remote interior state of Pensiangan (33%) and remote coastal seat of Kota Marudu (32%) in Sabah. These abnormal high increases raise questions.

The placement of new voters is even more intriguing when studying the actual polling stations results. Many new voters are concentrated in more less populated areas within constituencies, often in rural and semi-rural seats.

The placement of new voters is even more intriguing when studying the actual polling stations results. Many new voters are concentrated in more less populated areas within constituencies, often in rural and semi-rural seats.This is where the questions over the large number of unexplained voters grouped in bunches in places like Bachok (21% new voters and won by PAS with less than 1% margin) and Bukit Gantang (29% of new voters and won by PAS with 2% margin) come in.

It appears that the localised remote placements of new voters may have had an impact. For example, the placement of 3,600 new voters in a remote Felda schemes occurred in Segamat, which was won by the BN with a 1,217 majority. The voting in this Felda scheme was over 90%, with one stream at 99%. In 2004, the voter turnout in this area was much lower.

This spike pattern of voter turnout in particular polling stations was found in Terengganu in 2004, when the BN wrested back the state, and questions were raised at that time as well.

Spike patterns out of line

This GE13 spike in voter turnout at the local level is being witnessed in specific places across the country. With the national level of turnout at 80%, the spike patterns that are well out of line with historic patterns of voting behaviour raise questions, even accounting for the overall rise in participation and voter turnout.

Another pattern in the placement of new voters beyond tight races involves prominent leaders getting large shares of new voters, such as Najib Razak’s own seat Pekan with 38% new voters, or Rompin represented by Jamaluddin Jarjis at 29% new voters. It remains unclear why these largely rural constituencies would have such large voter increases.

Generally out-migration areas such as Perak and Pahang receiving large numbers of new voters does not conform with population patterns. Why are places with people leaving to work outside get sharp increases in voters?

The lack of clear transparent explanations on why voters are registered in some areas in such high numbers this election, compared to past patterns in these areas, understandably raises questions.

Many seats that were lost by the opposition or were in tight races have large number of new voters, including, including Tanah Merah (24%) and Balik Pulau (25%), although in some cases the opposition picked up or retained seats with large voter increases in these seats, such as Kota Raja (47%) and Kuala Nerus (25%), among others.

This issue of voter registration and voter turnout levels needs further study, with more information on who are these new voters and their pattern of voting. The fact is that the polling station results will show the spikes at the local level and careful study will tell us statistically the impact of these new voters on electoral outcomes.

The Electoral Commission (EC) and electoral administration as a whole are facing a real trust deficit. A reliable electoral roll is essential for any fair elections. Repeatedly questions have been raised about the veracity of many new voters.

Election watchdog Merap and others have time and again drawn to the questions of electoral roll integrity. Before the polls, these matters were essentially ignored or dismissed. To date, the scope of phantom voters and questionable placement was not fully known. Now the results themselves will show the impact at the local level.

This is why the sharing of all results through the Borang 14 is essential in order to make a systematic and thorough assessment. Preliminary reviews of results are already raising red flags as they have shaped the outcomes at both the parliamentary and state levels.

Early and postal voting