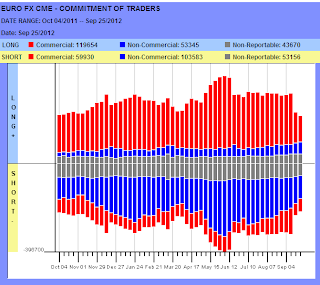

Beginning 2012 Euro was already sliding down from 1.4750 of 2011 and had reached 1.27 by Jan 2012. Greece was at the front and centre of all news and it was looking as if Euro is going to break up any-time And I was writing that we should keep an eye on the commercial position in the COT report. Commercials were increasing their long position throughout the year and even when Euro reached 1.20 in June/August of 2012, the long position of the commercials were at record high. In June 2012, the Euro long position in COT was at record level of 329K long vs. 70K short. In other word, when the Euro was reaching its low for the year, commercials were holding almost 5 long for 1 short.

Now when Euro has touched 1.32, we see that the commercials are reducing their long drastically. From the last week COT report, there are only 120K long vs. 60K short. Looking at other way, while there has not been major change in the short position, the long position has reduced by 64% over this period and most of these reductions have come in the last two weeks.

Regular readers know I had written in the past that demise of Euro is premature. But now it seems that the cows are coming home. Spain is going to ask for almost $ 300 billion by October end and after that Italy. There is not enough money in Europe to bail out 11 of the 17 members. And everyone expects Germany to pay up. I don’t think it is going to happen and my prediction of two years back that we might have two tired Euro, one for Northern Europe and one for Southern Euro, may well come true in 2013/2014.

The monthly chart of Euro is also very interesting;

It has made three attempts at 1.20 levels since 2008-9 and is now hanging just above there. If it breaks that level, there is only air below till 0.90 where it started its life.

Tom McClellan of McClellan Publication shows some interesting chart about Euro Dollar COT Position and according to him, the stocks somehow follows it with a 12 months lag. That indicator is reaching the top around November 2012 and dives 30000 ft down in 2013/14.

Seeing how the commercials operate on a very long term time scale, I do not think there is imminent danger and we will most likely get the final pop by November / December of 2012 but I would expect to take position on the defensive side thereafter.

On a shorter term time scale, coming week, it is very likely that we will see a test of SPX 1420. If we see SPX testing 1410-20 level and bouncing from there, I would most likely start taking long position. While going long, I would select sectors like Bio-technology (XBI), pharmaceuticals (SGEN), precious metals (CDE, AGQ, DGP) and TBT. Deutsche Bank and JPM both have buy recommendation on CDE and it has a beta of 1.5. However, PM sector is due for a pull back and most likely we will get the pull back this week. And since we are not day traders and want to take the correct position while avoid whipsaws, we better be patient before taking any position.

I am extremely thankful for your overwhelming response to my request. Guys please disable ADBLOCK . I am now spending more time on this blog and I need to survive. In future I plan to bring you reports on commodities like Corn, Wheat, Nat.Gas and other futures. It will help me to do more research on stocks, commodities and sector rotation. Thank you for your understanding and support.

Thanks for reading http://bbfinance.blogspot.com/ and join me in Twitter (@bbfinanceblog).

.png)