Spain, the latest combat zone in Europe's long-running debt wars, urged the euro zone to set up a new fiscal authority to manage the bloc's finances and send a clear signal to markets that the single currency project is irreversible.

Prime Minister Mariano Rajoy said the authority would also go a long way to alleviating Spain's woes which, along with the prospect of a Greek euro exit, have threatened to derail the single currency project.

Sitting as Spain does on an estimated €220 billion, or about $273 billion, in failed real estate loans alone — a number that surpasses the entire output of the Greek economy — there is little doubt that Spain, with the fourth-largest euro zone economy — behind Germany, France and Italy — is too big to fail. Or, more precisely, to be allowed to fail.

Analysts guess that a comprehensive rescue for Spain would cost €350 billion, and one for Italy would cost even more. Sums that large would quickly overwhelm the €500 billion available in the new European rescue fund, the European Stability Mechanism.

Indeed, many investors and money managers now see Europe’s challenge as not how to bail out sickly Spanish banks, but how to keep Spain and even Italy afloat and in the euro zone as money keeps leaving these countries, forcing interest rates up and leaving flaccid local banks as the only buyers of government debt.

It is not the first time a European leader has proposed creating such an authority but the problems and the size of Spain - a country deemed too big to fail - have prompted EU policymakers to hurriedly consider measures such as creating a fiscal and banking union ahead of a EU summit on June 28-29.

Analysts estimate that the amount needed to backstop failing Spanish banks is €60 billion to €80 billion, which on the face of it could come from Europe’s rescue fund.

The sticking point is that Spain wants Europe to inject money directly into these banks, as in the bank-bailout program in the United States in 2008 and a similar effort by the British government.

Germany, however, has no desire to swallow the bill for Spain’s bad banks, so it is insisting that funds be disbursed to the Spanish government and that strings be attached. It wants more draconian spending cuts and perhaps even losses for the mostly Spanish investors who hold the stocks and bonds of these failed banks. But as Berlin and Brussels butt heads with Madrid over who pays what, when and how, money continues to flee from Spain at an alarming rate. According to figures from the Spanish central bank, €66 billion left the country in March as investors sold Spanish stocks and bonds with abandon. And in April, the outflow of deposits from Spanish banks also picked up, with €31 billion leaving the Spanish banking system, according to the European Central Bank.

On consecutive days last week, two of the most powerful figures in Europe — Mario Draghi, president of the European Central Bank, and Olli Rehn, the most senior economic official in Brussels — warned that the future of the euro zone was in doubt. In the words of Mr. Rehn, the union might well disintegrate unless policy makers took steps to bind the euro’s 17 nations closer together.

Germany, the paymaster of the euro zone, and others insist such a move can only happen as part of a drive to much closer fiscal union and relinquishing of national sovereignty.

Overspending in the regions and troubles with a banking sector badly hit by a property crash four years ago have sent Spain's borrowing costs to record highs and pushed the country closer to seeking an international bailout.The risk premium investors demand to hold Spanish 10-year debt rather than German bonds rose to its highest since the launch of the euro - 548 basis points - on Friday.

The Spanish government, which has hiked taxes, slashed spending, cut social benefits and bailed out troubled banks, argues that there is little else it can do and the European Union should now act to ease the country's liquidity concerns.

In private, senior Spanish officials have said this could be done by using European money to recapitalize directly ailing banks or through a direct intervention of the European Central Bank on the bond market.

The head of the World Bank yesterday warned that financial markets face a rerun of the Great Panic of 2008. On the bleakest day for the global economy this year, Robert Zoellick said crisis-torn Europe was heading for the ‘danger zone’.

Mr Zoellick, who stands down at the end of the month after five years in charge of the watchdog, said it was ‘far from clear that eurozone leaders have steeled themselves’ for the looming catastrophe amid fears of a Greek exit from the single currency and meltdown in Spain.

The flow of money into so-called ‘safe havens’ such as UK, German and US government debt turned into a stampede last week. In Berlin the two-year government bond yield fell below zero for the first time, with the bizarre result that jittery international investors are now paying – rather than being paid – for lending to Germany.

The European Union itself is like a bubble. In the boom phase the EU was unreal but immensely attractive. The EU was the embodiment of an open society –an association of nations founded on the principles of democracy, human rights, and rule of law in which no nation or nationality would have a dominant position.

The process of integration was spearheaded by a small group of far sighted statesmen who practiced what Karl Popper called piecemeal social engineering. They recognized that perfection is unattainable; so they set limited objectives and firm timelines and then mobilized the political will for a small step forward, knowing full well that when they achieved it, its inadequacy would become apparent and require a further step. The process fed on its own success, very much like a financial bubble. That is how the Coal and Steel Community was gradually transformed into the European Union, step by step.

Germany used to be in the forefront of the effort. When the Soviet empire started to disintegrate, Germany’s leaders realized that reunification was possible only in the context of a more united Europe and they were willing to make considerable sacrifices to achieve it. When it came to bargaining they were willing to contribute a little more and take a little less than the others, thereby facilitating agreement.

The process culminated with the Maastricht Treaty and the introduction of the euro. It was followed by a period of stagnation which, after the crash of 2008, turned into a process of disintegration. The first step was taken by Germany when, after the bankruptcy of Lehman Brothers, Angela Merkel declared that the virtual guarantee extended to other financial institutions should come from each country acting separately, not by Europe acting jointly. It took financial markets more than a year to realize the implication of that declaration, showing that they are not perfect. That statement can be regarded as what set the current Euro crisis into a tailspin. When you are in a union, but your financials are largely your own business but not the union, you get yourself into loads of trouble, as you all have the same currency (i.e. interest rates).

This is a really huge point to grasp, because a nagging question has been: Why did the market think of Spain/Greece/Italy/Etc. as being risk-free sovereigns at one point, and then decide that they were not risk free and subject to credit risk.

Soros answer: Because they were essentially risk-free so long as the arc was always towards more integration. That ended when Merkel made the declaration above. The Maastricht Treaty was fundamentally flawed, demonstrating the fallibility of the authorities. Its main weakness was well known to its architects: it established a monetary union without a political union. The architects believed however, that when the need arose the political will could be generated to take the necessary steps towards a political union.

But the euro also had some other defects of which the architects were unaware and which are not fully understood even today. In retrospect it is now clear that the main source of trouble is that the member states of the euro have surrendered to the European Central Bank their rights to create fiat money. They did not realize what that entails – and neither did the European authorities. When the euro was introduced the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital; and the central bank accepted all government bonds at its discount window on equal terms.

Commercial banks found it advantageous to accumulate the bonds of the weaker euro members in order to earn a few extra basis points. That is what caused interest rates to converge which in turn caused competitiveness to diverge. Germany, struggling with the burdens of reunification, undertook structural reforms and became more competitive. Other countries enjoyed housing and consumption booms on the back of cheap credit, making them less competitive. Then came the crash of 2008 which created conditions that were far removed from those prescribed by the Maastricht Treaty. Many governments had to shift bank liabilities on to their own balance sheets and engage in massive deficit spending. These countries found themselves in the position of a third world country that had become heavily indebted in a currency that it did not control. Due to the divergence in economic performance Europe became divided between creditor and debtor countries.

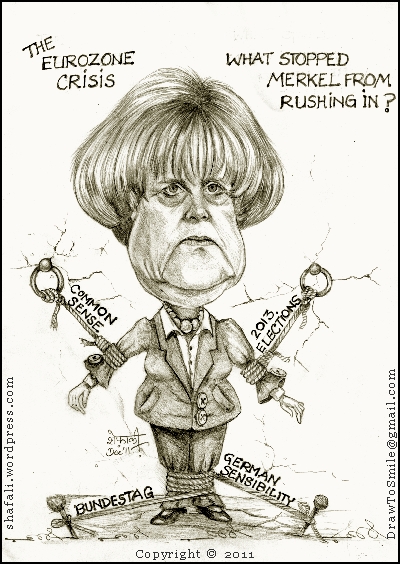

In the end its Merkel with Bundesbank that will make or break the Euro crisis. We need Germany to show leadership and preserve the European Union as the fantastic object that it used to be. The future of Europe depends on it.

Over the weekend, German Chancellor Angela Merkel is pressing for much more ambitious measures, including a central authority to manage euro area finances, and major new powers for the European Commission, European Parliament and European Court of Justice. She is also seeking a coordinated European approach to reforming labor markets, social security systems and tax policies.

Until states agree to these steps and the unprecedented loss of sovereignty they involve, the officials say Berlin will refuse to consider other initiatives like joint euro zone bonds or a "banking union" with cross-border deposit guarantees - steps Berlin says could only come in a second wave.

The goal is for EU leaders to agree to develop a road map to "fiscal union" at a June 28-29 EU summit, where top European officials including European Council President Herman Van Rompuy will present a set of initial proposals.

European countries would then put the meat on the bones of the plan in the second half of 2012, several European sources have told Reuters, including a timetable for overhauling EU treaties, a step Berlin sees as vital for setting closer integration in stone.

If European countries go ahead, the steps would represent the most significant policy leap since they agreed to give up their national currencies and cede control over monetary policy 13 years ago. But the hurdles are daunting. If they can, and they must, come up with a viable "banking union", that would SAVE the rest .... whether Greece will exit or not is not such a major issue anymore.

But, we will be watching what E.U. does best, serving up 3 weeks of fantastic competitive football. Not supporting Spain this time around, I will be rooting for the Czech Republic this time. They are the underdogs as the likes of Smicer, Pavel Nedved, Marek Jankulovski, Karel Poborsky and Jan Koller are long gone, ... watch for Petr Jiracek and Vaclav Pilar.