Commodities have been a good gauge of the strength of economic recovery. Hence are we saying the global economy is headed for a tailspin? A minor correction is understandable but the way they have been correcting implies there is something graver in the works.

Price of oil has fallen into a hole, so much so that it is below some of the OPEC members' production cost even. Other commodities have done likewise. What was interesting was that although gold did perk up, it did not reflect a stampede to get out of all assets with the fear of inflation in mind.

The negative yield into German papers indicate that people are rushing to solid currencies. Before we venture further let's look at the 2011 asset class returns. Almost everything went into a hole except for bonds, corn and oil. Hence we cannot say there had been any over exuberance over the past 18 months.

| 2011 Sector Performance | Performance | Potentially Similar ETF |

| Utilities | 13.10% | (XLU) |

| Healthcare | 10% | (XLV) |

| Services | 4.20% | n/a |

| Consumer Goods | 2.60% | (XLP) |

| Technology | -3.60% | (XLK) |

| Conglomerates | -3.90% | n/a |

| Indusrial Goods | -4.90% | (XLI) |

| Basic Materials | -10.40% | (XLB) |

| Financials | -18.80% | (XLF) |

| 2011 Capitalization Performance | Performance | Potentially Similar ETF |

| Large | -4.40% | (SPY) |

| Mid | -4.60% | (MDY) |

| Mega | -6.60% | (DIA) |

| Nano | -8.30% | n/a |

| Small | -9.10% | (IJR) |

| Micro | -16.10% | (IWC) |

| 2011 Index Price Performance | Performance | Potentially Similar ETF |

| S&P 500 | -0.02% | |

| Shanghai | -22.42% | (FXI) |

| Nikkei 225 | -17.34% | (EWJ) |

| Hang Seng Index | -19.27% | (EWH) |

| Euro Stoxx 50 | -18.41% | (FEU) |

| S&P/TSX Composite Index | -11.01% | (EWC) |

| 2011 Currency Performance | Performance | Potentially Similar ETF |

| EUR/USD | -1.30% | n/a |

| USD/JPY | -5.91% | n/a |

| USD/CAD | 1.64% | n/a |

| USD/CNY | -4.62% | n/a |

Note: currency ETFs do exist, but without detailed explanation of how they work I thought it prudent to leave out the tickers.

| 2011 Commodity Performance | Performance | Potentially Similar ETF |

| Gold | 10.19% | (GLD) |

| Oil | 6.33% | (DBO) |

| Natural Gas | -42.21% | (GAZ) |

| Silver | -9.75% | (SLV) |

| Copper | -19.56% | (JJC) |

| Wheat | -23.89% | (JJA) |

| Soybeans | -5.81% | " |

| Corn | 15.43% | " |

| 2011 Bond ETF Performance | Performance | ETF Used in Calculation |

| Long Term US Treasuries | 30.25% | (TLT) |

| iShares Aggregate Bond Fund | 4.68% | (AGG) |

| TIPS | 9.28% | (TIP) |

| Investment Grade | 5.17% | (LQD) |

| High Yield | -0.78% | (HYG) |

The Contango Effect

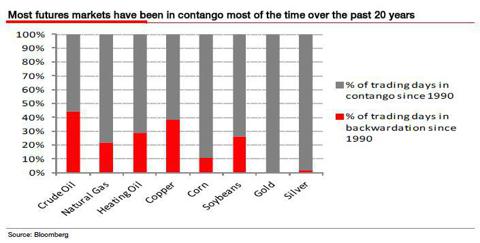

Malaysian market players from the 90s would be well aware of the word contango. Say you buy shares with minimal deposit or no deposit for say RM100,000 and you have no bloody intention of picking them up, or have the ability to. You have to rollover, that's contango. In the futures markets for commodities, a substantial portion of trades are contango trades.

A simple explanation for the commodities price fall would be that investors and traders have given up rolling over positions and just squaring. Generally in contango trades, you are usually long. It is infrequent that contango trades being short trades. Many hedge funds or large investors do contango trades because of the "super cycle theory", which Jim Rogers is famed for, i.e. we are supposedly on a very long bull run for commodities.

There are probably contributing factors to the diminishing contango positions: more ideal weather patterns for agriculture products (a weakened La Nina), a genuine reassessment that the China engine may not be as strong as first thought. Lump that in with the renewed E.U. crisis implosion (European elections), you have a potent mix.

Final Word - I do not think this is developing into a catastrophic scenario. I believe the correction in commodities is more a congruence of factors aligning itself at the same time. Nothing much to do but sit and wait.